Meet Tabet Nazer, a Funded Trader with Funding Frontier. Discover how Tabet and other traders secured funding and gain insights and tips for a successful trading journey.

Please introduce yourself: Who are you, your age, where you are from, and what you do for a living?

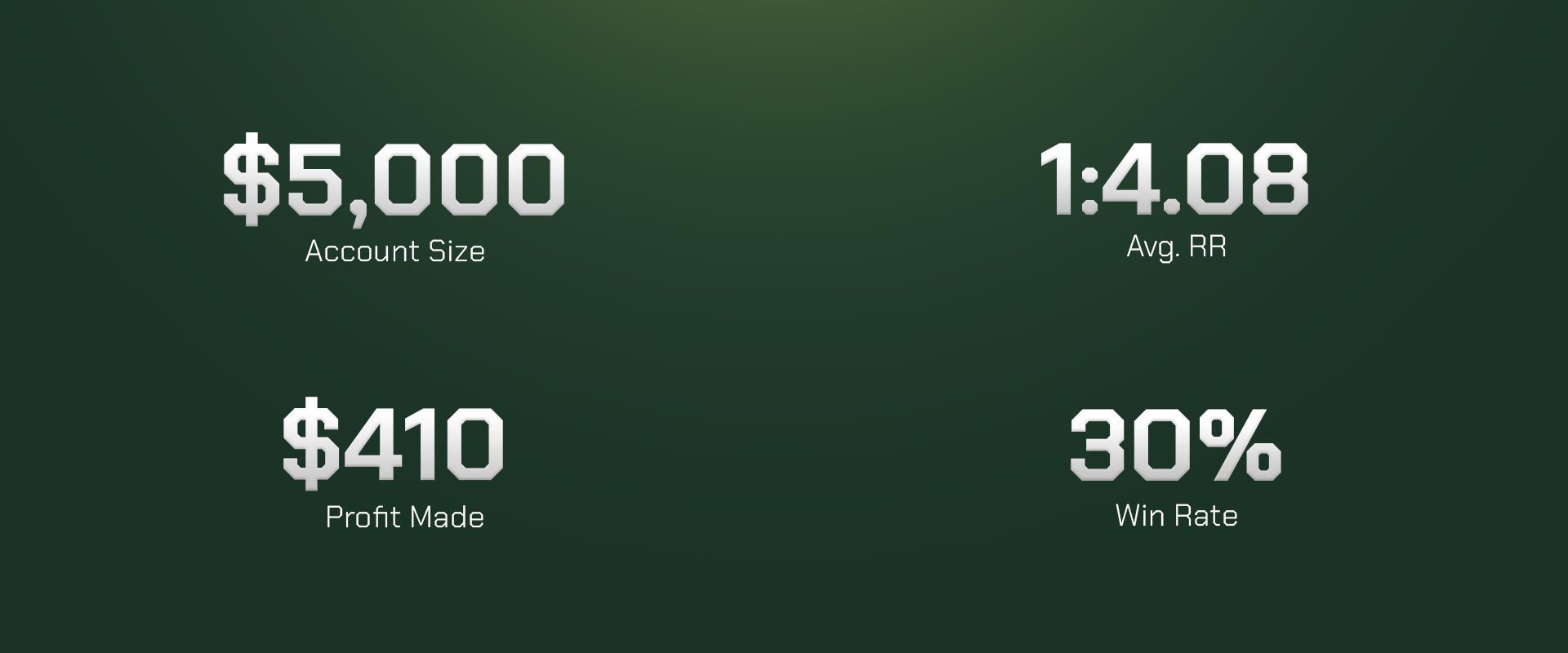

My name is Tabet Nazer. I’m 22 years old, from Algeria, and I work at an auto parts store.

How did you get introduced to trading?

I first got into trading as a way to earn some extra money on the side and support myself financially.

Do you have any hobbies, and what do you enjoy outside of trading? Do you find that these hobbies benefit your trading?

Outside of trading, I enjoy reading books, mostly fiction. Since it’s mostly entertainment, I wouldn’t say it has influenced my trading directly.

What is your trading routine?

I usually make some coffee and set up at my work computer around midnight my time. I start by reviewing what happened in the London and New York sessions the previous day, then wait for the Asian market to open.

What are your goals with funded trading?

Funded trading allows me to access much larger capital than I could provide myself. My goal is to continue growing this capital to maximize both my own profits and the firm’s.

Do you have a trading plan in place, and do you strictly follow it?

Yes, absolutely! Trading without a plan is just gambling. My plan involves reviewing the hourly chart for XAUUSD from the previous day, then monitoring the Asian session open. I watch the volume indicator for a spike in volume and wait for the right entry point, which could take seconds or sometimes hours. I always trade with a fixed Take Profit (TP) and Stop Loss (SL).

How would you describe your trading style?

Mechanical. I follow fixed entry parameters along with set TP and SL levels. This removes emotions from my trading.

What has been the most challenging obstacle in your trading journey?

The hardest part is research and testing. It makes up 99% of the work and takes a very long time.

What did you find easier: the Funding Frontier Challenge or the Verification phase?

Logically, the Verification phase should be easier because of the lower profit requirement. But for me, it was the opposite. Even though the Challenge has a higher profit target, it feels less stressful since you haven’t invested as much time into it. Losing during Verification feels tougher because of the time you’ve already spent.

How would you rate your experience with Funding Frontier?

It’s been excellent overall, though I think faster support response times would make it even better.

What advice would you give to other traders attempting the Funding Frontier Challenge?

Test your strategy thoroughly, control your nerves, and don’t gamble; take it seriously.

Do you plan to take another Funding Frontier Challenge to manage even bigger capital?

Yes, I hope to do that eventually.

Describe your best trade.

My best trade had a 1:13 risk-to-reward ratio, using the same strategy I follow consistently.

What is the number one piece of advice you would give to a new trader?

I can’t stress this enough: test your strategy!

How did you first hear about Funding Frontier?

I came across it while researching prop firms on sites like PropFirmMatch.

Can you describe your risk management plan?

My risk management is simple: fixed TP and SL. While my strategy has a relatively low win rate, the high risk-to-reward ratio makes it work very well over time.